Open House this Saturday

Seller is offering a $5000 concession towards CLOSING COSTS!!!!!.

Beautiful 4 bedroom brick home located in the Eagle Mt,Saginaw ISD on a large corner lot, in the quiet Liberty Crossing Subdivision.

Enter the foyer to the main living, with private study to the right, and a spacious formal dining to the left. The heart of the home is an open kitchen with built-in appliances, custom shaker cabinets, gas cooktop, large island and spacious pantry.

The modern concept brings together the kitchen, breakfast and family room. Huge game room, separate office down, and large living-kitchen makes this a must see.

Split bedroom arrangement with private master, which features oversized, soaking tub and split vanities. Large covered back patio and impressive backyard w brick fencing is perfect for entertaining or privacy. Full perimeter gutter system.

Priced to sell so don't miss this opportunity. Seller is motivated! Foundation recently repaired and under warranty. Freshly painted.

9301 Comanche Ridge Drive Fort Worth, TX 76131 Saturday July 8th from 1pm - 4pm

We found your new home!

We found your new home!

This cute, quaint Carrollton home is newly-renovated and movie in ready! Come see this family-friendly home with its large backyard and patio just minutes away from PCBT and NDT and only 20 minutes from downtown Dallas.

This is what AI thinks a typical home in Fort Worth looks like

For a typical Texas home, the AI chose a modest-looking house with a red brick exterior, a covered front porch with plenty of room for people-watching (very Southern), blue shutters, and a light blue door. And you can't forget the classic American flag that pokes in from the side of the frame – hanging off from what, we don't know.

A tall, old oak tree snakes above the perfectly mowed front yard, with a stone path leading from the street to the steps of the porch. Several trees decorate the side and back yards, providing the essential shade every Texan craves in the hot summer months.

All Star Home, which wrote the report, additionally pulled the median home value for each state and city that was included to determine how much each home could cost. Zillow says the average Texas home is worth $302,333 as of May 2023, so that's how much this Texas home could be worth.

Other Texas cities included in All Star Home's report are Fort Worth, Houston, Austin, San Antonio, and El Paso. Each idyllic home is unique, with both Fort Worth and Dallas sharing some German/European exterior features.

Zillow says the average Dallas home is worth $312,588 in May 2023, so homeowners will have to judge whether the AI-generated home matches that number or if it's wildly off base.

**Read More

**

Got plans this weekend?

Got plans this weekend?

You should head out to the Parker County Peach Festival!!

The 38th Annual Parker County Peach Festival is shaping up to be PEACHY with a bounty of Parker County Peaches and amazing vendors!

This year's event area has expanded by 25% and coordination of more than 200+ Arts/Crafts, Food and Activity Vendors is set! There will be food and arts and craft vendors, activity vendors, food vendors, entertainment stages, and the Annual Peach Pedal Bike Ride. You won't want to miss out on the fun!

Peach Festival Admission: $10 for adults $5 for kids ages 5-12 Kids under 5 are free Date: Saturday Jul 8, 2023 Time: 8:00 AM - 4:00 PM Location: Historic Downtown Weatherford

Two Questions To Ask Yourself if You’re Considering Buying a Home

Two Questions To Ask Yourself if You’re Considering Buying a Home

If you’re thinking of buying a home , chances are you’re paying attention to just about everything you hear about the housing market. And you’re getting your information from a variety of channels: the news, social media, your real estate agent, conversations with friends and loved ones, overhearing someone chatting at the local supermarket, the list goes on and on. Most likely, home prices and mortgage rates are coming up a lot.

To help cut through the noise and give you the information you need most, take a look at what the data says. Here are the top two questions you need to ask yourself about home prices and mortgage rates as you make your decision:

1. Where Do I Think Home Prices Are Heading?

One reliable place you can turn to for that information is the Home Price Expectation Survey (https://pulsenomics.com/surveys/#home-price-expectations) from Pulsenomics – a survey of a national panel of over one hundred economists, real estate experts, and investment and market strategists.

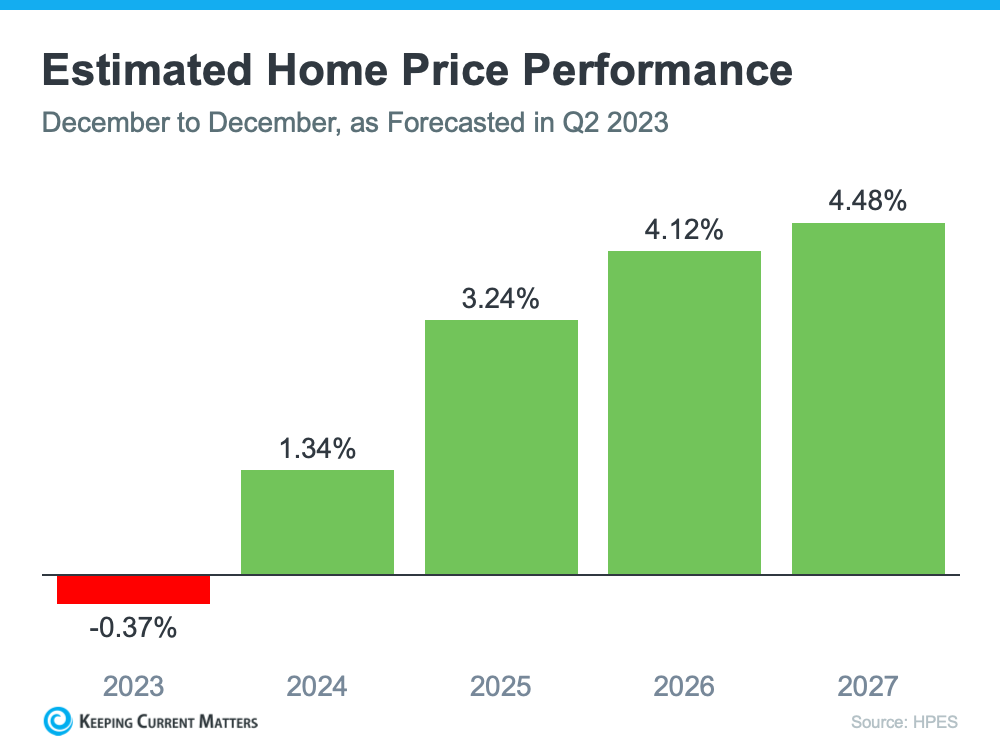

According to the latest release, the experts surveyed are projecting slight depreciation this year (see the red in the graph below). But here’s the context you need most. The worst home price declines are already behind us, and prices are actually appreciating again in many markets. Not to mention, the small 0.37% depreciation HPES is showing for2023 is far from the crash some people originally said would happen.

Now, let’s look to the future. The green in the graph below shows prices have turned a corner and are expected to appreciate in 2024 and beyond. After this year, the HPES is forecasting home price appreciation returning to more normal levels for the next several years.

So, why does this matter to you? It means your home will likely grow in value and you should gain home equity in the years ahead, but only if you buy now. If you wait, based on these forecasts, the home will only cost you more later on.

2. Where Do I Think Mortgage Rates Are Heading?

Over the past year, mortgage rates have risen in response to economic uncertainty, inflation, and more. We know based on the latest reports that inflation, while still high, has moderated from its peak. This is an encouraging sign for the market and for mortgage rates. Here’s why.

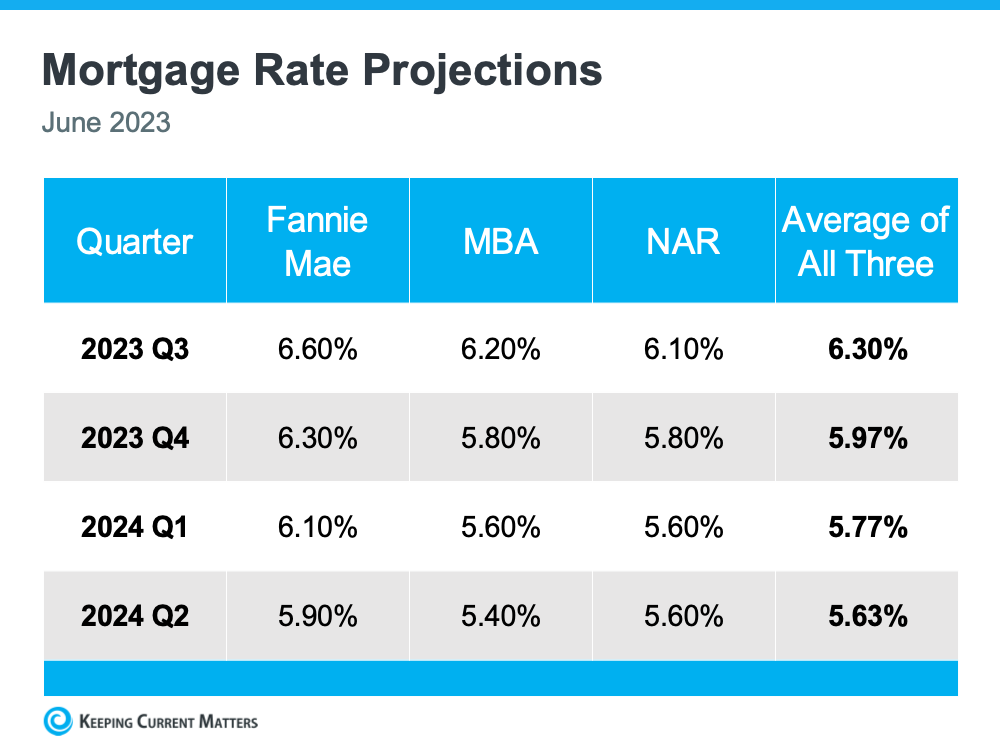

When inflation cools, mortgage rates generally fall in response. This may be why some experts are saying mortgage rates will pull back slightly over the next few quarters and settle somewhere around roughly 5.5 and 6% on average.

But, not even the experts can say with absolute certainty where mortgage rates will be next year, or even next month. That’s because there are so many factors that can impact what happens. So, to give you a lens into the various possible outcomes, here’s what you should consider:

- If you buy now and mortgage rates don’t change: You made a good move since home prices are projected to grow with time, so at least you beat rising prices.

- If you buy now and mortgage rates fall (as projected): You probably still made a good decision because you got the house before home prices appreciated more. And, you can always refinance your home later on if rates are lower.

- If you buy now and mortgage rates rise: If this happens, you made a great decision because you bought before both the price of the home and the mortgage rate went up.

Bottom Line

If you’re thinking about buying a home, you need to know what’s expected with home prices and mortgage rates. While no one can say for certain where they’ll go, expert projections can give you powerful information to keep you informed. Lean on one of our trusted real estate professionals who can add in an expert opinion on your local market.